-

Why invest in Entra

-

Share and analyst information

-

Reports and presentations

-

Financing

-

Governance

-

ESG

Financing

-

Effective leverage

54 %

As of Q4-2023

-

ICR

1,84 %

As of Q4-2023

Moody's credit rating

On 1 November 2023 Moody's Investors Service ("Moody's") changed Entra´s long-term issuer rating to the Investment Grade rating of Baa3, and the outlook was changed to stable.

"The rating action balances weakening credit metrics in particular due to rising interest costs with good rental growth, a solid liquidity profile and limited short term debt maturities", said Maria Gillholm, Moody's Lead Analyst for Entra.

"The stable outlook factors in the expectation of cash preserving measures and the likelihood of further asset disposals, which should strengthen liquidity further and improve effective leverage", added Ms. Gillholm.

"The changed issuer rating does not affect the interest rate on debt for existing loan facilities. We are pleased to see that Moody's in its rationale highlights Entra's superior asset quality and our modern and high-quality office property in attractive locations. The stable outlook for the Investment Grade rating also reflects Entra's tenant base consisting of mostly government and public tenants with long dated average lease terms and consistently high occupancy rates", said Sonja Horn, CEO in Entra.

Green Financing

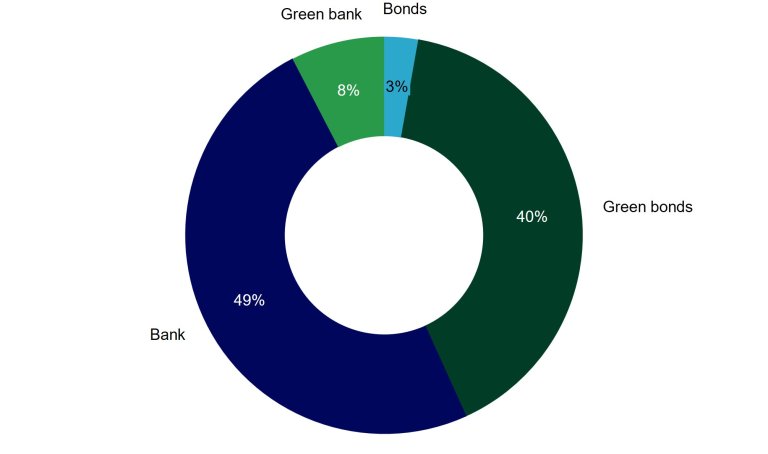

Having a sustainable portfolio and portfolio management is key for achieving long-term profitability. It affects our ability to attract capital at attractive terms, the valuation of our property portfolio and our ability to attract and retain customers and employees. Entra is well positioned to utilise green bank and bond financing as its portfolio mainly consists of environment friendly and BREEAM certified properties. As a result, Entra is established as a high-quality Green Bond issuer that has issued thirteen Green Bonds since 2016 as well as two green bank loans.

Entra’s green financing is subject to external review. Shades of Green by S&P Global (formerly part of CICERO) has issued a Second Opinion on Entra’s Green Bond Framework. Deloitte has issued an independent limited assurance of the Green Bond report, hereunder that the selection process for the financing of Eligible Assets and the allocation of the net proceeds of the Green Bonds are done in accordance with Entra’s Green Bond Framework. The Green Bond Framework, the Second Opinion issued by Cicero, and the Green Bond Reports are available on Entra’s website.